What are income distributions?

Income distributions occur when a unit trust fund distributes the net income, which is the income earned in the fund, minus the permissible fund expenses.

The fund earns income from investing in underlying instruments, which includes REIT income, interest income and dividends. Income distributions are paid out periodically, on the fund’s distribution dates as stated in the supplemental deed of the fund and disclosed on the relevant fund’s MDD.

The frequency of income distributions varies across funds. That said, funds with a larger allocation to short-term interest-bearing instruments tend to declare income distributions more frequently, typically quarterly, while funds with larger allocations to growth assets tend to distribute income less frequently, typically half yearly.

In instances where the income earned in the fund is less than the expenses, the fund will not have any income to declare and the income distribution will, therefore, be zero.

What happens when distributions are paid?

The daily NAV (Net Asset Value) price of a fund consists of a capital portion and an income portion. When a fund pays out the income portion of the fund as part of the income distribution, the daily NAV price of the fund will decrease by the amount of income distributed on the day that the income is paid out, known as the distribution date. Investors in a fund have the option to reinvest income distributions in the same fund or have the income paid into their bank account.

Why would a client’s market value decrease on their statement?

The NAV price of the fund will decrease as the income is paid out of the fund to the investors. All things being equal, the drop in NAV price will equal the income amount being paid out to investors and will cause the investor’s market value of their investment to decrease by the amount received as an income distribution. The income distribution may then be used by the investor to buy more units in the fund (in other words, they are reinvested).

We must highlight, though, that the drop in the NAV price of the fund won’t necessarily equal the income distribution of the fund, as the fund value will be subject to daily market movements. Income distributions are also not the same every time as it depends on the amount of income earned by the fund for each particular distribution period. Previous income distributions can be found on the MDD of the fund.

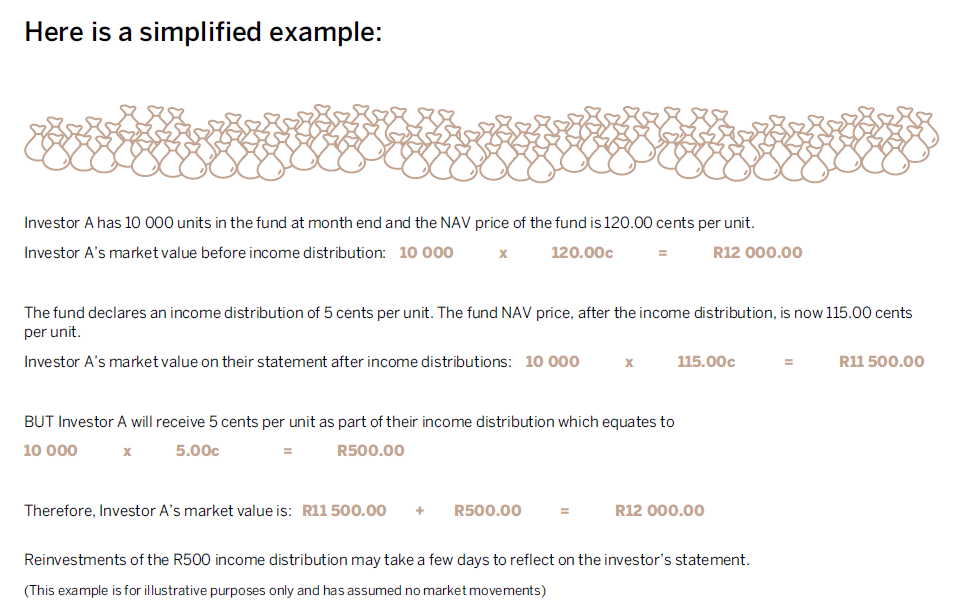

Here is a simplified example:

Investor A has 10 000 units in the fund at month end and the NAV price of the fund is 120.00 cents per unit. Investor A’s market value before income distribution:

The fund declares an income distribution of 5 cents per unit. The fund NAV price, after the income distribution, is now 115.00 cents per unit.

Investor A’s market value on their statement after income distributions:

BUT Investor A will receive 5 cents per unit as part of their income distribution which equates to

Therefore, Investor A’s market value is:

Reinvestments of the R500 income distribution may take a few days to reflect on the investor’s statement.

(This example is for illustrative purposes only and has assumed no market movements)