Understanding Unit Trusts

Investing your money can be a daunting prospect, especially if you’re not sure where to begin. However, investing in a unit trust can be an effective way to invest your money in a safe and regulated manner. In this article, we will explore the concept of unit trusts, their advantages and whether they are safe investment options.

What is a unit trust?

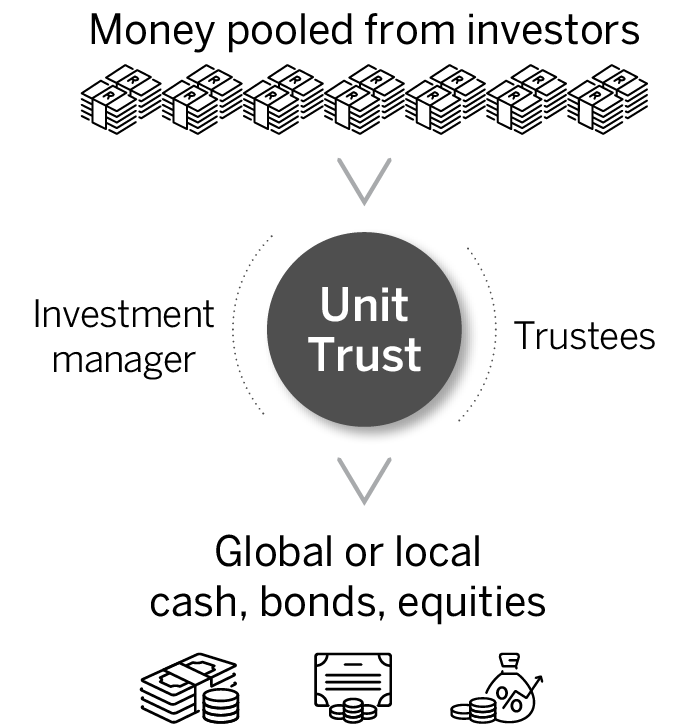

A unit trust is a collective investment scheme that pools money from multiple investors to buy a portfolio of assets. The money collected is used to buy units in the fund, which represent a proportional share of the total assets. Each unit has a price based on the value of the underlying assets, which changes based on the performance of the fund. The assets of a unit trust can be made up of cash, bonds, listed property and/or shares, or a combination of these. The allocation to different asset classes depends on the risk profile of the fund.

The first unit trust in South Africa was launched in June 1965 and has since grown to R3.41 trillion (as at December 2022, source: ASISA) in assets under management. This growth is attributed to the affordability and accessibility of unit trusts, which make them a popular investment option for many South Africans.

Are unit trust investments safe?

Unit trusts are considered safe investment vehicles because they are highly regulated and monitored by the Financial Sector Conduct Authority (FSCA). The Collective Investments Schemes Control Act, 45 of 2002 (CISCA) governs unit trusts, which are required to have a supplemental deed registered with the FSCA, stipulating the investment objective, among other requirements. Each registered unit trust is also required to appoint trustees, ensuring that the investors’ money is held in a trust. The investment manager, including both the individual and the company who decide what to invest in, are required to register with the FSCA. The regulations provide legal safeguards and transparency, which ensures that the unit trusts are safe investment options.

Unit trusts in brief

Advantages of investing in a unit trust

There are several advantages to investing in a unit trust. Firstly, they are affordable and accessible, with flexible investment contributions, lump sums or debit orders. This makes them accessible to most investors. Secondly, unit trusts offer broad diversification from a single investment, allowing investors to spread their risk across multiple asset classes. Thirdly, investors gain access to professional investment management expertise, which they may not have on their own. Finally, unit trusts are tax-effective, with capital gains tax (CGT) only payable at withdrawal.

As such, unit trusts are an excellent investment option for individuals who are looking for safe and cost-effective investment vehicles. With the industry being highly regulated and continuously monitored, unit trusts offer investors transparency, diversification, and access to professional investment management expertise. If you’re considering investing in a unit trust, speak to a financial advisor who can help you determine which unit trust is best suited to you and your financial goals.